Incentive Stacking

Incentives can be used together to maximize home improvement project savings

Many home projects are eligible for multiple incentives, and to maximize cost savings households should use, or “stack,” as many government incentives as they qualify for in their home upgrade projects. Household tax credits for energy efficiency and clean energy upgrades can often be stacked with other financial incentives, including state and local programs.

Federal Incentives for Clean Energy Home Projects

| Project | Incentive Program |

|---|---|

| Home Upgrades | |

| Air Source Heat Pump | Home Electrification and Appliance Rebate |

| Energy Efficient Home Improvement Credit 25C | |

| Home Efficiency Rebate | |

| Geothermal Heat Pump | Clean Energy Tax Credit 25D |

| Home Efficiency Rebate | |

| Home Electrification and Appliance Rebate | |

| Heat Pump Water Heater | Home Electrification and Appliance Rebate |

| Energy Efficient Home Improvement Credit 25C | Home Efficiency Rebate |

| Induction Cooking Equipment | Home Electrification and Appliance Rebate |

| Home Efficiency Rebate | |

| Heat Pump Clothes Dryer | Home Electrification and Appliance Rebate |

| Home Efficiency Rebate | |

| Energy Generation & Storage | |

| Solar | Residential Clean Energy Tax Credit 25D |

| Battery Storage | Residential Clean Energy Tax Credit 25D |

| Weatherization | |

| Air Sealing | Home Electrification and Appliance Rebate |

| Home Efficiency Rebate | |

| Energy Efficient Home Improvement Credit 25C | |

| Insulation | Energy Efficient Home Improvement Credit 25C |

| Home Efficiency Rebate | |

| Home Electrification and Appliance Rebate | |

| Doors | Energy Efficient Home Improvement Credit 25C |

| Home Efficiency Rebate | |

| Windows | Home Efficiency Rebate |

Stacking Rules

When government incentives are stacked, different program requirements must be considered and can impact the value of each credit. The federal government has published the following guidance on stacking tax credits and rebates. Check income eligibility and performance requirements as they can impact what can stack together.

Tax Credit Stacking

Generally, tax credits for homes, which include the Energy Efficient Home Improvement Credit 25C and Residential Clean Energy Property Credit 25D, can be combined with other incentives. Rebates and utility incentives must be applied before the 25C and 25D tax credits, must be incorporated into tax form paperwork, and could impact the value of the credit. Other federal and non-rebate state incentives do not impact the value of the credit.

Utility incentives

Generally, if a utility provides a subsidy to a customer for the purchase or installation of any energy conservation measure, the taxpayer must claim the cost of the qualifying purchase minus the utility subsidy on the tax form. Net metering compensation is not considered a subsidy.

Rebates

Regardless of the program administrator, rebates generally follow similar rules to utility incentives. If a rebate is provided for an energy conservation measure, the taxpayer must claim the cost of the qualifying purchase minus the rebate on the tax form. This applies for rebates provided to the household, manufacturer, distributor, or seller/installer. Federal, state, and local rebates all qualify under these rules.

State energy efficiency incentives

A taxpayer does not need to reduce the cost of their qualifying purchase on a tax form if the state incentive is not a rebate. While many states label their energy efficiency incentives as “rebates,” these incentives may not qualify as rebates or purchase-price adjustments under federal income tax law and could be included in the taxpayer’s gross income for federal income tax purposes. In general, rebates are nontaxable purchase price reductions if they are based on or related to the cost of the property, received from someone having a reasonable connection to the sale of the property (for example, the manufacturer, distributor, or seller/installer), and do not represent payment or compensation for services provided by the taxpayer.

Rebate Stacking

The Home Efficiency Rebates (HER) and Home Electrification and Appliance Rebates (HEAR) are the two main federal rebates for home improvement projects.

Combining Federal Rebates (HER & HEAR)

The HEAR and HER rebates can be stacked for the same household retrofit project but cannot be stacked for the same efficiency or electrification measure. There are additional restrictions for retrofit projects pursuing the measured savings pathway for HER:

- Only HEAR rebates for electric panel and wiring upgrades can be accessed by an address that is in the process of receiving a HER rebate using the measured savings approach.

- A household in the process of receiving a HEAR rebate associated with an energy-savings product like a heat pump cannot simultaneously receive a HER rebate using the measured savings approach (or vice versa).

Non-federal funds

Non-federal funds (i.e., state or local funding, utility programs, or philanthropic funds) can stack with the IRA rebates when those state, local, utility, and philanthropic program requirements do not have additional stacking restrictions.

Federal tax credits

The federal Energy Efficient Home Improvement Tax Credit 25C can stack with rebates. The credit is based on the cost of the applicable product after applying rebate funds.

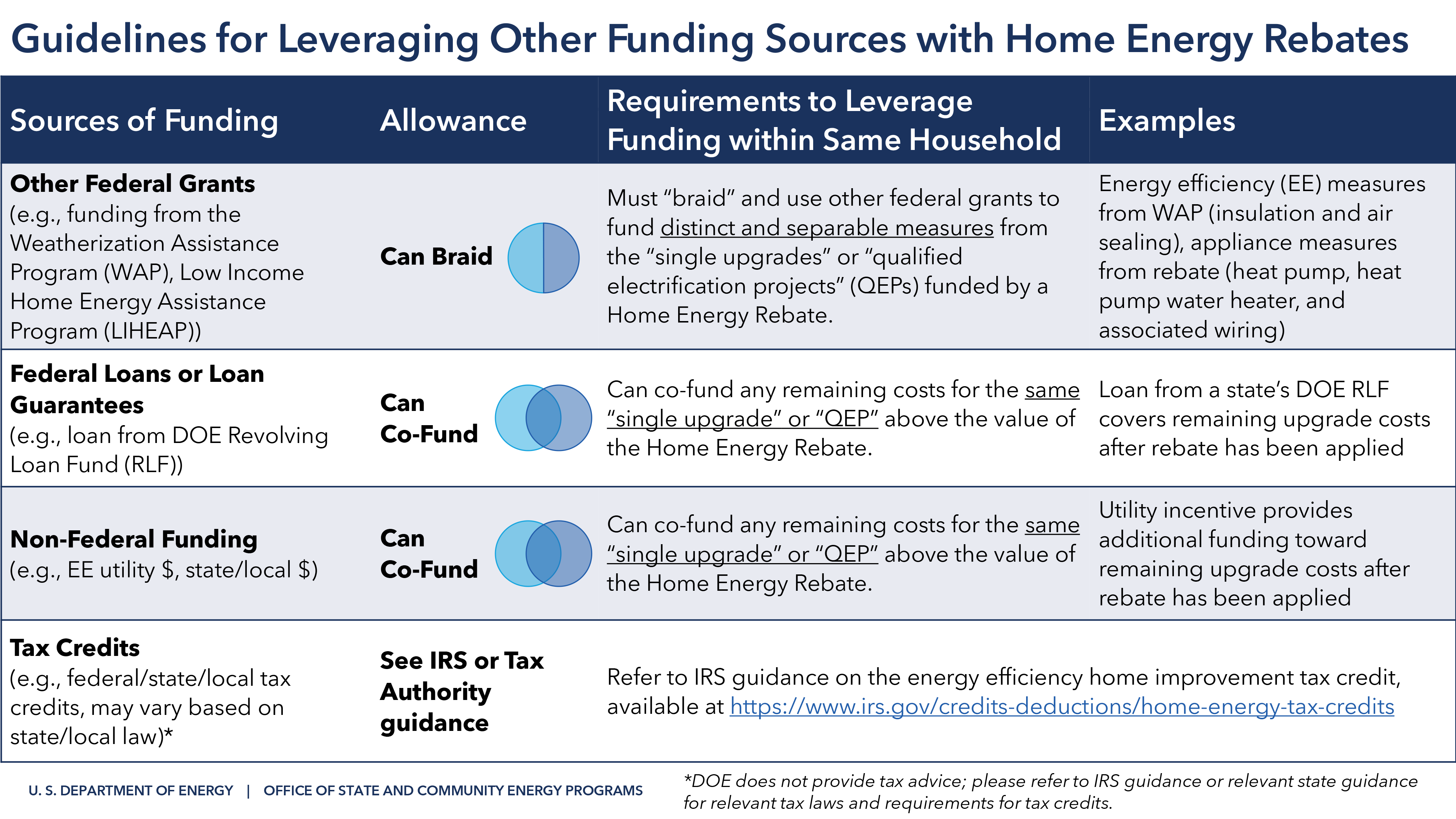

Use the US Department of Energy Guidelines for Leveraging Other Funding Sources with Home Energy Rebates below to understand how HER and HEAR can be combined with other incentives.

Source: U.S. Department of Energy

Stacking Example

The following are examples of how federal, state, and utility incentives stack. Please research your own local, utility, and state incentives to find programs you may be eligible for.

| Example of how a middle-income household would maximize utility and federal incentives for a $5,200 heat pump water heater | |||

|---|---|---|---|

| Order of Application | Funding Source | Incentive Amount | Cost of Upgrade Post Incentive |

| 1 – Submit paperwork prior to installation | Home Electrification and Appliance Rebates | 50% up to $1,750 | $3,450 |

| Installation occurs | |||

| 2 – Submit paperwork after installation | Local electric utility incentive or state specific rebate | $300 | $3,150 |

| 3 – Submit application when filing federal taxes | Energy Efficient Home Improvement Credit 25C | $945 (30% of project cost after utility incentive, up to $2,000) | $2,205 |

| Total project cost after incentives | $2,205 | ||